Substantially-All Test for the R&D Credit

Our last article focused on documenting the process of experimentation on R&D business components. A key aspect of the requirement is that “substantially all” of the activities constitute elements of a process of experimentation. How much is “substantially all” and how have IRS audits been changing as a result of recent tax law?

Qualified Research under the Internal Revenue Code

- The “substantially all” requirement is satisfied if 80 percent or more of a taxpayer’s research activities constitute elements of a process of experimentation that relates to a qualified purpose.

The percentage can be measured on cost or other consistently applied reasonable basis and is applied separately to each business component. If the business component doesn’t reach the minimum threshold (i.e. 80%), the company must apply the test at the next sub-level of the business component (AKA the shrink back rule).

Substantially-All Court Case

Little Sandy Coal Co. v. Commissioner is the first case to discuss in detail how to calculate the substantially-all test. Little Sandy Coal Co, a shipbuilder contracted with customers to design, fabricate, and deliver a tanker barge and a floating dry dock. The tanker barge required redesign of an existing product design, and the floating dry dock required development of an entirely new product design.

The taxpayer argued that more than 80% of the time spent on the tanker barge constituted elements of a process of experimentation. The taxpayer included as direct research the wages paid employees who fabricated the tanker barge on the theory that the barge was a pilot model that required fabrication to test and evaluate the newly designed components.

The court applied a mathematical calculation of direct research wages / total expenses to determine whether the substantially-all test was met. The court limited direct research to the engineering employee who performed the engineering calculations. It excluded certain activities such as draftsmen who recorded specifications of design alternatives, employees who supervised other employees performing research as well as the material cost incurred to fabricate the tanker barge as a cost of performing an element of the experimental process. While many of these exclusions were reversed on appeal by the 7th Circuit, the ultimate result was that the tax credit was denied because the taxpayer did not offer a principled way to determine what portion of the employee activities for each vessel constituted elements of a process of experimentation, much less research activities.

IRS Audit Impacts

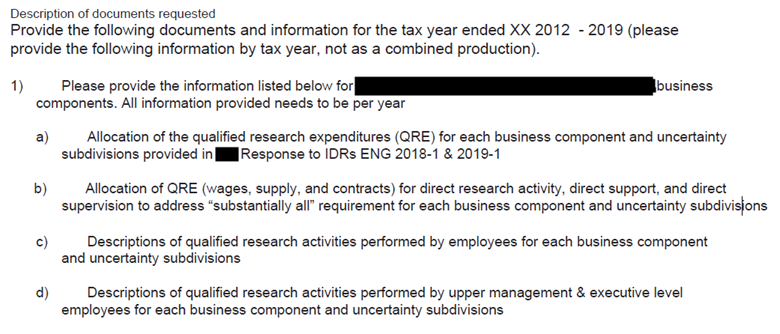

The Little Sandy Coal case was considered a win for the IRS and subsequent IRS audits of R&D credits adopted the formula for determining if they research activities met the “substantially-all” requirements for each business components. Below is an excerpt of an R&D audit information document request, requesting an allocation of qualified research expenses for direct research, direct support, and direct supervision for each business component going back to 2012.

Most taxpayers have not classified otherwise eligible R&D costs into those three categories (direct research, support, and supervision), making it a challenge to comply with IRS data requests. Additionally, many of the employees that fall into the support or supervision category (e.g., managers, directors, product managers) tend to be highly compensated, making it difficult to meet the 80% threshold if the allocation was measured on cost. While the 7th Circuit’s ruling made it clear that support, supervision, and material costs should be included in the substantially-all calculation, the IRS has not acquiesced on the revised calculation method in all jurisdictions.

One strategy being adopted by taxpayers is to classify as much of the research activities into direct research and limit the support and supervision classification to activities described in the treasury regulations. Thus, if you have a technical manager performing direct research and supervising development, a portion of that employees’ time should be classified as direct performance rather than just supervision.

Being prepared to respond to IRS audits related to the substantially-all requirement is critical to sustaining R&D credit claimed.

Next Step

Would you like a second opinion on the quality of your R&D credit calculation process and supporting documentation. Let’s talk.

Schedule a Call