Navigating the Proposed Regulations under IRS Section 987

Understanding tax law can be a complex endeavor. The Section 987 rules around translating currencies for certain foreign subsidiaries are no exception. With recent proposed regulations released in November 2023, understanding Section 987 has become more crucial than ever. In this post, we’ll explore these new proposed rules, delving into their implications for tax practitioners. Here we attempt to unravel the complexities of Section 987 and equip ourselves to tackle its challenges head-on. But first, let’s establish some foundational definitions.

Key Definitions

1. Qualified Business Unit (QBU)

- A QBU embodies a branch, entity, or division that, for U.S. tax purposes, is disregarded as separate from its owner.

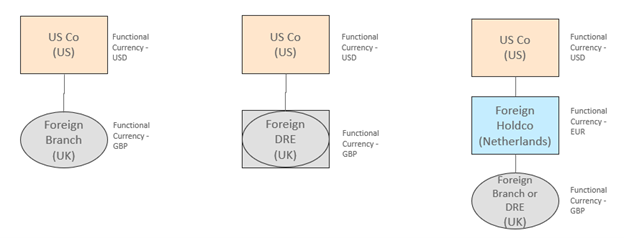

- For Section 987 purposes, we’re generally only concerned about QBUs with functional currencies that differ from that of their tax owner.

- QBUs are often used in global enterprises, and their functional currencies become focal points under Section 987.

2. Functional Currency

- The functional currency serves as the primary currency in which a QBU routinely conducts its business.

- It’s the currency that aligns with the QBU’s operational context.

- For example, if a Japanese subsidiary predominantly operates in Japanese yen, the Japanese yen becomes its functional currency.

The Importance of Section 987

Background

- Section 987 was provided to give guidance on currency translation involving QBUs for US tax purposes.

- Think of a US company with a QBU that operates in a different functional currency. When the income of the QBU is earned, it is taxed by the US shareholder, but when the cash is distributed in a later period, it may be converted at a different rate than the initial income.

- Section 987 ensures that currency fluctuations between the time when income is taxed and when it is distributed or converted don’t distort taxable income or loss calculations—it is a safeguard against unintended tax consequences.

The 2016 Final Regulations

- The IRS has issued several sets of regulations around Section 987, including regs issued in 1991, 2006, 2016, 2019, and now 2023.

- In 2016, the IRS finalized regulations introducing the foreign exchange exposure pool (“FEEP”) method.

- The FEEP method created significant complexity for taxpayers with QBUs.

2. The FEEP Method Explained

Functional Currency Determination

- QBUs must first establish their functional currency, as discussed above.

Asset Types and Translations

- QBUs must first split their assets between two types as defined in the regulations.

- The first type is financial assets (“marked” items). These are typically assets whose value fluctuate regularly based on market dynamics.

- Financial asset values are translated using the spot rate at the end of the year.

- Other nonfinancial assets (such as real estate or intellectual property) use historical rates for currency translation.

The FEEP Pool: Net Value Changes

- Based on these translations, QBUs aggregate their foreign exchange exposure within the FEEP. Foreign exchange differences become part of a pool of unrealized gains or losses.

- When remittances between the QBU and an owner occur, a portion of the foreign exchange gains or losses from the pool become recognized.

The 2016 regulations were never finalized. The IRS continued to defer applicability dates while stating that changes were being considered. Until then, any reasonable method could be used.

3. What’s New in the 2023 Proposed Regulations?

Scope Expansion

- Previously excluded entities (banks, insurance companies, REITs, S Corporations, Partnerships, etc.) are now included in the regulations.

Refining the FEEP Method

- The proposed regulations maintain the FEEP structure but add a few key pieces.

- Key adjustments:

- Transition Rule: QBUs can transition seamlessly to the new rules. Rather than having to calculate the FEEP pool beginning balance using historical rates across any number of years, a QBU’s balance sheet is generally translated at the spot rate on the day before the transition date.

- Annual Recognition Election: Rather than pooling unrealized gains and losses, taxpayers can elect to recognize all foreign currency gain or loss annually.

- Current Rate Election: Taxpayers can also elect to treat all items of a QBU as marked items (financial assets). This removes the need to use historical rates for balance sheet and income statement items.

- Under this method, losses are suspended until gains are recognized.

- Both elections, once made, apply for five years.

Applicability

- These rules have yet to be finalized; however, they’re expected to take effect for tax years starting after December 31, 2024.

- Early adoption can apply, if done consistently.

- If a QBU is terminated after 9 November 2023 but before the above applicability date, early transition may be required.

4. Practical Considerations and Takeaways

Compliance Challenges

- Taxpayers with QBUs face the task of adapting to the proposed regulations. These calculations may be more complex than previous methods used.

- Consider the applicability of elections. These can greatly simplify calculations but may have unintended tax consequences. Modeling may be helpful.

Documentation Matters

- Maintain records of functional currency determinations.

- Document methods & calculations related to unrecognized gain or loss.

Conclusion: Navigating the New Regulations

The proposed regulations under IRC Section 987 represent a new element to consider in a company’s overall international tax strategy. While they’re not yet finalized, they signal the IRS’s intent. Tax professionals should stay informed, assess their QBUs, and seek expert advice while navigating these complex issues.

Schedule a Call